Automotive Coolant Aftermarket Size & Share Outlook 2025–2035 Driven by Innovation and Sustainability

Global demand for advanced coolant solutions grows as automakers, suppliers, and service providers adapt to evolving powertrains

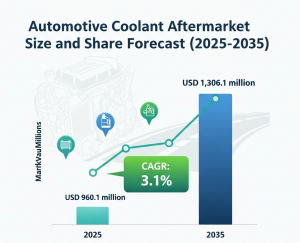

NEWARK, DE, UNITED STATES, August 25, 2025 /EINPresswire.com/ -- The global automotive coolant aftermarket is entering a decisive growth phase, marked by innovation, sustainability, and adaptation to increasingly complex powertrain systems. Valued at USD 960.1 million in 2025, the market is projected to reach USD 1,306.1 million by 2035, expanding at a CAGR of 3.1%. At the center of this transformation is a shared focus on advanced formulations, lifecycle cost efficiency, and OEM-certified compatibility—factors driving both manufacturers and service providers toward higher-value solutions.

Market Growth Anchored in Servicing and Performance Needs

The aftermarket continues to expand in line with heightened diligence in vehicle servicing. Larger global fleets, extended ownership cycles, and turbocharged powertrain adoption have intensified engine thermal loads, requiring coolants capable of ensuring stable performance across broader temperature ranges. For manufacturers, this reinforces the necessity of delivering products that not only meet evolving specifications but also reduce total cost of ownership for fleets and consumers.

In January 2025, PEAK announced new antifreeze and coolant products designed for next-generation, high-output engines. These OAT-compatible formulations deliver extended service life and cross-application utility, from passenger cars to commercial fleets. “Our product innovation strategy is rooted in meeting evolving engine cooling demands and reducing total cost of ownership,” stated Brian Bohlander, Director of Marketing at Old World Industries.

AISIN Corporation also expanded its antifreeze portfolio in 2024, targeting broader coverage of Japanese, Korean, and American models. By prioritizing enhanced corrosion resistance and multi-season reliability, AISIN strengthened its position in an increasingly compatibility-driven market.

Shaping the Industry Through Product Innovation

Mid-2024 also saw PEAK launch dual-purpose coolants for hybrid applications, acknowledging the growing share of electrified powertrains. These innovations highlight the aftermarket’s role in shaping automotive transformation, aligning with stricter emission standards and longer service intervals. Key trends driving coolant reengineering include:

1. Thermal conductivity optimization for higher efficiency.

2. Compatibility across materials in diverse cooling systems.

3. Low-toxicity formulations to meet environmental mandates.

4. Lifecycle efficiency for fleet operators seeking long-term savings.

As performance thresholds rise, platform-specific product differentiation and lifecycle-oriented coolant strategies are expected to define market expansion and competitiveness.

Investment Hotspots and Key Segments

The aftermarket landscape is being redefined by investment in both product types and sales channels.

1. Inorganic Segment – Stable and Cost-Effective

In 2025, inorganic formulations accounted for 49% of market share, growing steadily at a 2.8% CAGR through 2035. Their cost efficiency, compatibility, and material stability sustain adoption across high-volume platforms. OEM endorsements and Tier-2 supplier activity in cost-sensitive markets reinforce this segment’s resilience.

2. Independent Garages – Expanding Service Role

Independent garages held 29% of market share in 2025, with projected CAGR of 3.4%. Their growth reflects the rising share of out-of-warranty vehicles and consumer demand for accessible, multi-brand servicing. Regional garage networks in Southeast Asia, Latin America, and Eastern Europe are scaling service offerings beyond coolant replacement, capitalizing on flexible sourcing and competitive pricing.

Challenges and Growth Opportunities

Despite healthy expansion, the aftermarket faces pressing challenges. Stricter environmental regulations demand compliance in disposal and recycling of ethylene and propylene glycol-based coolants. Compatibility issues persist, creating risks when incompatible fluids are mixed. Additionally, market fragmentation from private labels intensifies competition and erodes OEM dominance.

However, these challenges also create space for innovation:

1. EV-Specific Coolants tailored to battery and hybrid systems.

2. Bio-based and biodegradable formulations with reduced toxicity.

3. AI-powered predictive thermal management, enabling live monitoring and proactive service.

These opportunities position coolant producers to align with the megatrends of electrification, sustainability, and digitalization.

Country-Level Outlook

Regional growth reflects varying levels of electrification, regulatory priorities, and service infrastructure:

1. United States – CAGR 3.6% driven by long vehicle lifespans, consumer focus on engine protection, and robust service networks supporting OAT and HOAT coolants.

2. United Kingdom – CAGR 3.4% as vehicle owners adopt tailored coolants for hybrids and EVs, emphasizing long-term dependability.

3. European Union – CAGR 3.5% with emphasis on sustainability, emission standards, and electrification, accelerating innovation in eco-friendly formulations.

4. Japan – CAGR 3.4% supported by hybrid and EV adoption, alongside domestic engineering advances in thermal management.

5. South Korea – CAGR 3.6% as electro-mobility investments drive demand for specialized battery-compatible coolants.

Competitive Landscape

The aftermarket’s competitive field is defined by innovation in corrosion inhibitors, extended-life antifreeze, and AI-enabled predictive servicing. Leading players and their strategies include:

• Prestone Products Corporation (20–25%) – Long-life coolant solutions with AI-driven engine cooling analytics.

• Valvoline Inc. (12–16%) – Universal gas and diesel coolants with predictive fluid health monitoring.

• Royal Dutch Shell PLC (10–14%) – Heavy-duty coolant technologies with corrosion-resistant properties.

• ExxonMobil Corporation (8–12%) – OEM-approved formulations integrating predictive thermal efficiency tools.

• TotalEnergies SE (5–9%) – Hybrid and EV-compatible coolants with sustainability at the core.

Other notable contributors include Castrol, Chevron, BASF, Clariant, and Amsoil, each advancing high-performance, eco-friendly, and AI-powered solutions for future-ready thermal management.

Industry Outlook: Driving Toward Lifecycle Efficiency

The automotive coolant aftermarket is steadily transitioning from being a routine maintenance item to a strategic enabler of long-term vehicle performance. With electrification reshaping powertrain needs and environmental mandates tightening, manufacturers and suppliers are positioned to gain from forward-looking innovation.

From inorganic formulations sustaining affordability to EV-specific coolants enabling next-generation thermal management, the aftermarket provides manufacturers with opportunities to strengthen value chains, support customers with longer service intervals, and ensure environmental compliance.

Request Intelligent Transportation System Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-11693

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us

As global fleets expand and powertrain diversification accelerates, the industry’s future will be defined by its ability to balance cost efficiency, performance durability, and sustainability—making coolant innovation a cornerstone of growth in the decade ahead.

Explore Related Insights

Automotive Electric Actuator Market:

https://www.futuremarketinsights.com/reports/automotive-electric-actuator-market

Automotive Spring Market :

https://www.futuremarketinsights.com/reports/automotive-spring-market

Automotive Cowl Screen Market:

https://www.futuremarketinsights.com/reports/automotive-cowl-screen-market

Automotive Closed Loop Current Transducer Market:

https://www.futuremarketinsights.com/reports/automotive-closed-loop-current-transducer-market

Automotive Ultracapacitor Market:

https://www.futuremarketinsights.com/reports/automotive-ultracapacitor-market

Editor’s Note:

This press release is based exclusively on market data, company announcements, and segment analysis provided within the supplied content. It is intended for industry stakeholders, aftermarket suppliers, and manufacturers seeking to align with evolving coolant technologies, regulatory standards, and customer service expectations.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.